Qualifies For Carbon Credit Exchanges

One of the most popular ways to mitigate emissions is through the purchase of carbon credits. These credits can be obtained by direct capture from the atmosphere or through an offset program. In order to participate in the market, businesses must meet certain criteria.

In addition, companies must disclose their emissions and their targets for reducing them. If their emissions fall within the cap, they can sell their carbon credit exchange. Purchasing a credit will allow them to offset a ton of CO2e. However, not all businesses can reduce their emissions at the same rate. For example, some businesses have years to go before they reach the target for reducing their greenhouse gas emissions. In these cases, they must find other methods of addressing their emission levels. This is where the voluntary carbon market comes into play.

The voluntary carbon market is designed to complement the regulatory carbon market. It is a global initiative that is growing in popularity. The voluntary market allows businesses to work with environmentally conscious offset sellers. The market works differently from the regulatory market.

What Qualifies For Carbon Credit Exchanges?

There are several organizations that offer carbon trading services. These include CTX, AirCarbon Exchange, and ACX. Each of these organizations use different technologies to facilitate the exchange of carbon offsets.

CTX, for example, has locations in Asia, Europe, and Australia. It offers carbon credits in four currencies, including GBP, AUD, EUR, and USD. Its client base is comprised of more than 130 organizations. Since its launch in 2017, it has traded hundreds of millions of tons of offsets. ACX also uses distributed ledger technology to create securitized carbon credits. The exchange takes advantage of the speed of blockchain technology to facilitate efficient carbon transactions.

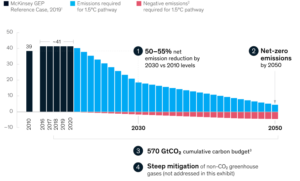

In order to qualify for the voluntary carbon market, companies must meet certain prerequisites. They must be able to provide detailed information on their plans to achieve their greenhouse gas emission targets. They must also be able to identify specific product-level, enterprise-wide, and service-level claims. They must demonstrate that they are committed to science-aligned long-term net-zero emissions by 2050. They should also show positive socioeconomic impacts and robust processes.

Another key requirement for participants in the voluntary carbon market is to adhere to a set of core carbon principles. These include price-risk management and price signaling. They can be combined with other standard attributes to create a common taxonomy for classifying carbon credits. This will ensure the appropriate use of carbon credits and improve the functioning of the voluntary carbon market. The Integrity Council for Voluntary Carbon Markets is an independent body that provides governance for the voluntary carbon market. It has issued draft Core Carbon Principles in July of 2022 for public consultation.

If you are interested in establishing a voluntary carbon market, it is important that you understand how it works and that you take steps to address the key issues that plague it. These include lack of liquidity in the market and inadequate risk management services.